Trendline Health | Edition 4

Margin Squeeze vs. Mission Risk

Curated insights on healthcare’s biggest moves: Policy shifts, finance, innovation, and leadership trends. Powered by real-time analysis from top sources.

Quick Takes: OBBBA’s $900B+ Medicaid cuts now endanger urban safety-nets as much as rural hospitals, while payer audits surge 30% and denials climb 14% amid employer costs hitting $17,496 per employee. Abbott’s $21B Exact Sciences grab accelerates oncology diagnostics consolidation, but rural OB units continue to vanish (down 11% since 2020), even as AI scales quietly from genomics to nursing handoffs. Overall themes: Margin squeeze vs. mission risk.

Policy & Regulation

OBBBA Fallout, Medicaid Strain, and PBM Pushback

As the One Big Beautiful Bill Act’s (OBBBA) $900B+ Medicaid cuts begin to bite, urban safety-net hospitals face the same existential threats as their rural counterparts, with Harvard’s analysis flagging 109 “most vulnerable” facilities—85% urban—that could shutter trauma and training programs. States, already projecting flat enrollment but 7.9% spending growth in FY26, are slashing provider raises and curbing GLP-1 coverage to brace for shortfalls, while bipartisan momentum builds for PBM reforms that could finally delink rebates and ban spread pricing.

State Medicaid Officials Project Flat Enrollment but Rising Costs and Budget Pressures(KFF.org): Amid post-unwinding stabilization, Medicaid spending rose 8.6% in FY25 and is forecast to climb another 7.9% in FY26, driven by long-term services, pharmacy, and behavioral health demands. Impact: Two-thirds of states anticipate at least a 50-50 chance of budget shortfalls, prompting fewer rate hikes and new restrictions on obesity drug coverage, exacerbating access strains as OBBBA’s provider tax limits loom.

“The challenging fiscal climate and the magnitude of federal Medicaid cuts will make it difficult for states to absorb or offset the reductions.”

— KFF Medicaid Budget Survey

Many Urban Safety-Net Hospitals Threatened by OBBBA Medicaid Cuts (Fierce Healthcare / Harvard HQO Lab): Researchers identified 109 hospitals (85% urban) at highest closure risk due to high Medicaid mix, financial distress, and competitive markets, many serving as major teaching centers. Impact: Potential cascade of service line cuts or conversions to outpatient-only models, widening uncompensated care burdens; the $50B rural fund’s urban exclusion is a “glaring oversight” that could spike maternal and trauma mortality.

Crapo, Wyden to Reintroduce Bipartisan PBM Package (Healthcare Dive): The revived bill targets spread pricing in Medicaid and rebate delinking in Medicare Part D, aiming to curb middlemen profits that inflate drug costs. Impact: Could save billions in net pricing but risks pushback from PBM giants, testing Republican-Democrat resolve amid broader affordability debates.

Growth & Finance

Profitability Chasm Widens, Denials Surge, Payer Profits Dip

The gap between hospital haves and have-nots has never been starker, with top-quartile margins hitting +14.7% while the bottom quartile languishes at -1.8%, even as volumes tick up 4% YoY—yet drug expenses and payer pushback continue to erode gains for many. Employer costs reached a record $17,496 per employee (+6%), forcing 55% to hike deductibles, while Abbott’s $21B cash swoop for Exact Sciences catapults oncology diagnostics into mega-consolidation territory, potentially lowering screening costs but inviting FTC scrutiny.

National Hospital Flash Report – September 2025 (Kaufman Hall): Adjusted operating margins held steady at 2.9% YTD, but regional disparities deepened—Western hospitals down 12% YoY—amid rising discharges and ED visits offset by stubborn drug inflation. Impact: Smaller systems must master throughput or risk falling further behind, as top performers leverage scale to weather denial storms.

Payer Audits, Denial Amounts Rise Again in 2025 (Fierce Healthcare / MDaudit): External audits jumped 30% per customer, with average denial values up 12% inpatient and 14% outpatient, including a 22% spike in Medicare Advantage claims. Impact: Overwhelms revenue cycles, forcing write-offs or appeals that could shave 2-3% off margins; coding and medical necessity remain top triggers.

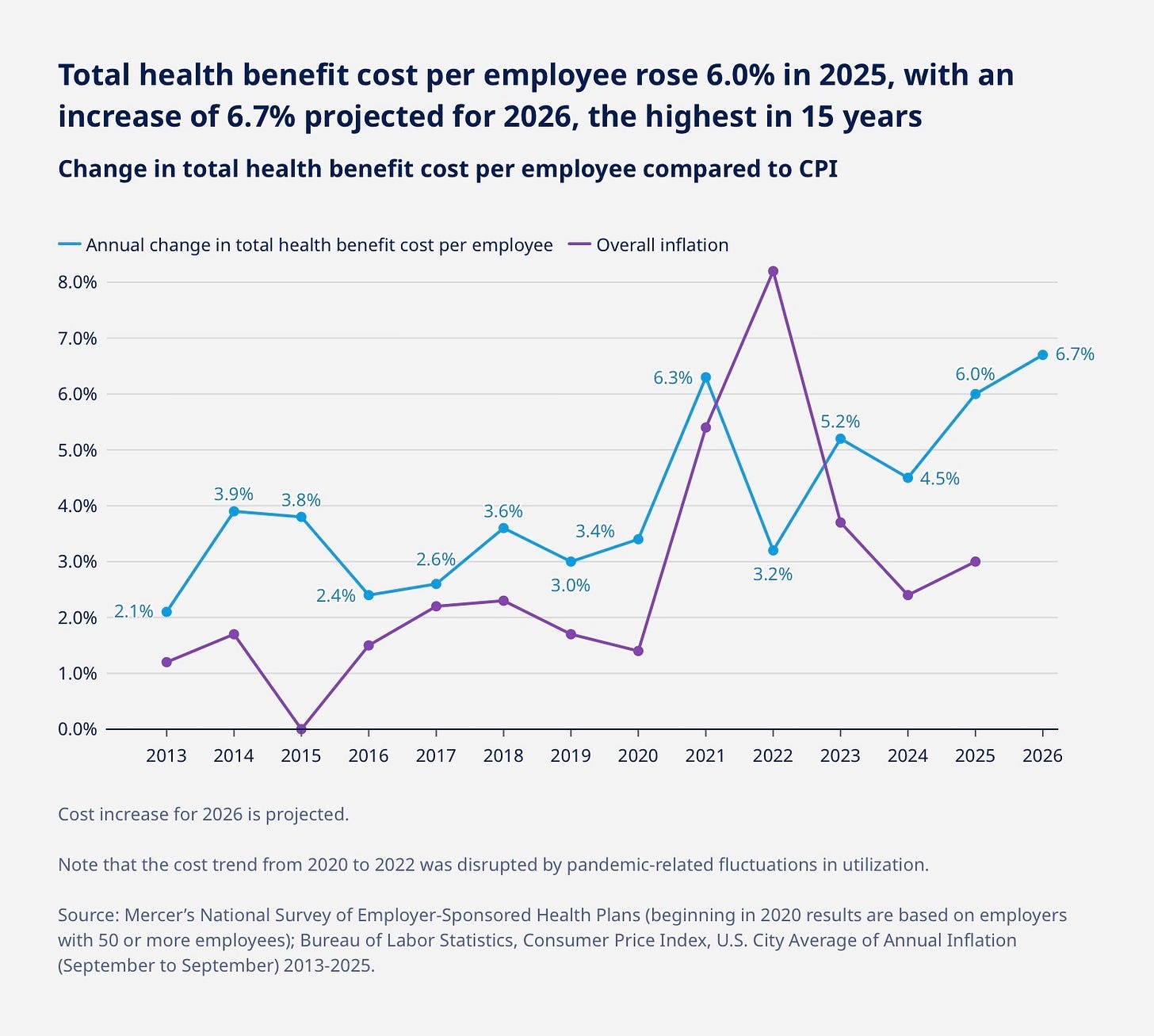

Employers Challenged as Costs Soar (Mercer National Survey): Health plan costs per employee hit $17,496 (+6.0%), with initial 2026 renewals averaging +9.2% before adjustments, fueled by 9.4% prescription drug hikes and GLP-1 uptake. Impact: Majority of large employers will shift more costs to workers via higher deductibles, accelerating narrow networks and direct contracting as subsidies sunset.

Abbott to Acquire Exact Sciences for $21 Billion (Abbott): The $105/share deal (45% premium) merges Cologuard’s non-invasive screening with Abbott’s diagnostics empire, targeting a $60B U.S. oncology market. Impact: Immediately accretive to revenue, potentially cutting screening costs 15-20% via scale, but heightens antitrust risks amid 10% projected colorectal cancer rise by 2030.

“Exact Sciences’ innovation, its strong brand and customer-focused execution are unrivaled in the cancer diagnostics space, and its presence and strengths are complementary to our own.”

— Robert B. Ford, Abbott Chairman and CEO

Quorum Health to Launch IT, Revenue Cycle-Focused MSO (Becker’s): The rural operator’s new MSO prioritizes cost parity over vendor margins, starting with its 12 hospitals to tackle EHR and back-office bloat. Impact: Enables resource pooling before private players dominate the $50B rural fund, potentially saving 20-30% on admin for independents.

Estimates of the Value of Federal Tax Exemptions and Community Benefits Provided by U.S. Nonprofit Hospitals, 2022 (AHA.org): Nonprofits delivered $149B in benefits (e.g., charity care, education) vs. $13.2B in forgone federal taxes—a 11:1 ratio underscoring mission over profit. Impact: Bolsters case for tax status amid scrutiny, but rising uncompensated care under OBBBA could strain the balance.

Innovation & Tech

AI Goes Clinical and Global

From decoding the genome’s “junk” DNA to plug-and-play tools reaching 55M lives, AI is transitioning from hype to operational scale, yet its promise hinges on equitable deployment amid margin pressures that sideline smaller players.

ARC at Sheba Medical Center and Mount Sinai Launch Collaboration with NVIDIA(GlobeNewswire): The three-year partnership leverages LLMs on massive datasets to unlock the 98% non-coding genome, targeting regulatory elements for disease prevention. Impact: Could redefine precision medicine, but data silos and compute costs may widen urban-rural innovation gaps.

From 1.2M Patients to 55M Lives: How Mayo Clinic is Scaling Its Expertise Globally(Becker’s): Platform_Insights deploys 53 AI algorithms as “tech containers” into EHRs worldwide, shrinking idea-to-implementation from years to weeks. Impact: Democratizes elite care for under-resourced hospitals, touching 40x more lives—but requires global data diversity to avoid bias.

How AI is Already Playing a Role at the Country’s Largest For-Profit Hospital Chain(Fierce Healthcare): HCA’s Google partnership synthesizes records for 400K weekly nurse handoffs (live in 8 hospitals), plus GE-fetal monitoring AI under FDA review. Impact: Reduces handover errors (a top risk) and burnout, potentially saving millions in labor—but clinical validation lags ops wins.

Access & Public Health

Rural OB Crisis Deepens

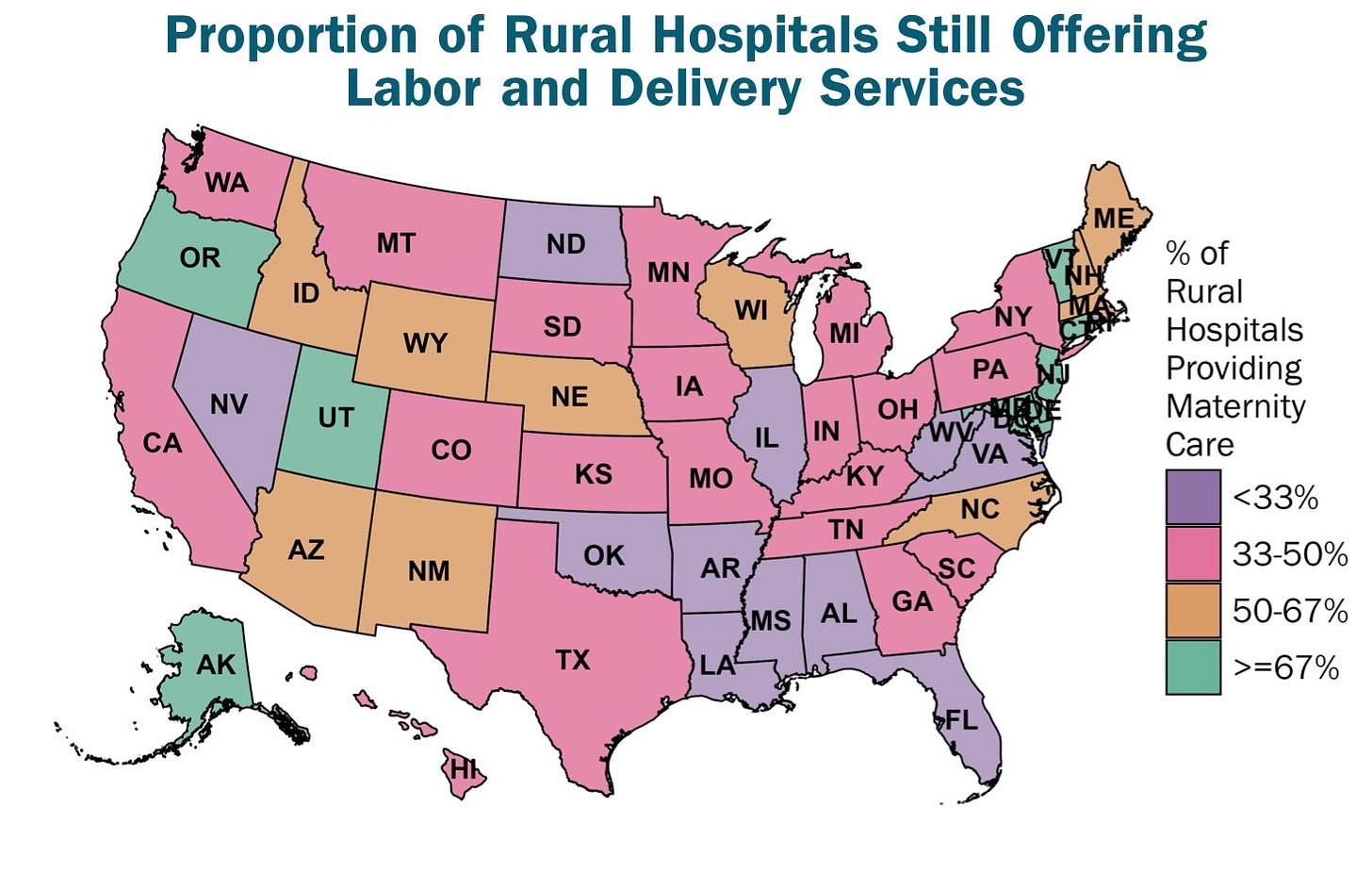

The erosion of rural maternity services accelerates, with 117 hospitals shuttering OB units since 2020—now just 41% remain—exacerbating maternal mortality and forcing families into hour-long drives, a stark reminder that mission-driven care often buckles under financial strain.

Stopping the Loss of Rural Maternity Care (CHQPR): Average two closures monthly since 2021, with travel times exceeding 50 minutes for many, per the latest tracking. Impact: Spikes C-section and complication risks; reform calls for “standby + delivery fee” payments to sustain viability.

Suggested Visual: U.S. map of rural OB closures (2021–2025) by state, with travel-time heat map.

Employers & Benefits

Cash-Pay Push Gains Traction

As ACA subsidies teeter on the cliff, direct-to-consumer models like cash-pay drugs and HSA rerouting gain steam, empowering self-insured employers to sidestep PBM opacity and insurer middlemen—though implementation hurdles remain in a landscape of soaring deductibles.

Mark Cuban Implores Employers to Consider Cash Pay, Simplify Contracting (Fierce Healthcare): Cuban urges self-insured plans to mandate deductible credits for cash-pay and use Cost Plus Wellness’ 9,200-provider network with public pricing. Impact: Bypasses PBM “auctions,” potentially slashing biosimilar costs 15-25%, but requires rewriting contracts amid broker resistance.

House Republicans Weigh Sending ACA Dollars to Consumers (Becker’s Payer): Proposal echoes Trump’s call to route subsidies directly to HSAs, bypassing exchanges for “better” coverage. Impact: Could cut insurer profits but risks coverage gaps if not paired with guardrails, as premiums spike post-subsidy expiration.

Sources: All summaries based on linked articles. For deep dives, visit the URLs.

Feedback? Reply to mark@trendlinehealth.com