Trendline Health | Edition 2

Cost Containment vs Access Equity

Curated insights on healthcare’s biggest moves: Policy shifts, finance, innovation, and leadership trends. Powered by real-time analysis from top sources.

Quick Takes: Premium growth (KFF) aligns with operator expansions (Tenet/UHS) and ACA subsidy shocks. Policy tweaks (CMS, 340B) could fuel innovation needs (Mayo/Lilly/Mount Sinai/WashU). Overall, 2026 themes: Cost containment vs. access equity.

Policy & Regulation

Medicare Tweaks, Payer Crackdowns, and Workforce Hurdles

Highlighting key drivers of 2026 costs and the ongoing tensions in reimbursement, drug discounts, and access. Meanwhile rural and underserved areas face amplified risks from visa changes.

While top-line pay bumps sound positive, the devil’s in the details: Specialty and hospital-based cuts could exacerbate workforce shortages, pushing more docs toward outpatient models and widening urban-rural divides.

Medicare Finalizes Controversial Cuts to Specialty Care in 2026 (Healthcare Dive): CMS released the 2026 physician fee schedule, imposing cuts to specialty services amid budget neutrality requirements. This could strain high-cost procedures, with critics arguing it undermines access.

CMS Boosts Physician Pay for 2026, But Hospital-Based Docs May See Losses (Fierce Healthcare): Overall physician reimbursements rise 3.77% for advanced payment models and 3.26% for others, driven by statutory updates and the “One Big Beautiful Bill Act.” However, facility-based docs face reduced indirect expense payments, favoring primary care while hitting specialties like oncology (up to 20% cuts for some). Telehealth expansions (e.g., permanent virtual supervision) offer a silver lining amid the shutdown.

HHS Secretary Robert F. Kennedy Jr.: “The new Medicare fee schedule delivers a major win for seniors, protects hometown doctors, and safeguards American taxpayers. It realigns doctor incentives and helps move our country from a sick-care system to a true health care system.”

AMA Statement: “While we are pleased to see a marginal increase… today’s final rule includes many policies that will threaten the financial sustainability of medical groups… [estimated] 37% of oncologists facing cuts between 10% to 20%.”

Payers are tightening screws on perceived loopholes, but providers argue it shifts costs downstream, potentially inflating premiums for employers (echoing KFF’s survey below).

Anthem to Penalize Facilities Using Out-of-Network Providers Starting Jan. 1 (Fierce Healthcare): Elevance’s Anthem plans in 11 states will hit in-network facilities with 10% claim penalties for using OON providers in non-emergent cases, citing NSA IDR abuse for “back-door” high payments (e.g., $60K awards for breast reductions vs. Medicare’s $1,145). Hospitals risk termination; AHA expresses concern over surprise billing trends.

HRSA Approves 8 Drugmakers for 340B Rebate Pilot (Fierce Healthcare): Trump’s admin greenlit rebate models for 10 drugs (e.g., Eliquis, Stelara) in a one-year test swapping upfront 340B discounts for post-purchase rebates. Hospital groups decry added admin burdens ($72M average float for DSH hospitals); while PhRMA praises transparency. Over 1,200 comments opposed, fearing harm to safety-net providers.

Shutdown stalls ACA fixes, but subsidy cliff hits now, echoing KFF’s premium warnings.

ACA Open Enrollment Launches Nov. 1 Amid Subsidy Expiration Uncertainty (CNBC): Enhanced premium tax credits (extended through 2025 via Inflation Reduction Act) face Dec. 31 cliff, potentially doubling out-of-pocket payments for 22M subsidized enrollees (from $888 to $1,904 avg. annually per KFF). Shutdown (now Day 20) delays support; Democrats tie extension to funding deal, Republicans push separate talks. Enrollment boom at risk: 4M could lose coverage by 2034 without renewal.

$100K H-1B Visa Fee Could Hit Rural/Poor Communities Hardest (Fierce Healthcare): JAMA study: H-1B-sponsored docs (1% of workforce) are 1.6% of rural physicians vs. 0.95% urban; twice as prevalent in high-poverty counties. Fee hike risks shortages in underserved areas; calls for waivers. (Lawsuits from AMA, AHA ongoing.)

Growth & Finance

Operators Bet on High-Acuity and Outpatient Expansion

Focus is on earnings-driven strategies amid rising demand. Hospitals are pivoting to specialized, efficient care models for revenue growth. As inpatient margins tighten (per CMS cuts above), operators like Tenet and UHS are chasing high-margin outpatient and specialty plays. Expect more M&A or partnerships to scale amid workforce constraints.

Tenet Pledges More Investment in High-Acuity Growth for 2025 (Healthcare Dive): Hospital giant Tenet plans heavier spend on organic expansion and high-acuity lines (e.g., surgeries), citing strong service demand. Q3 earnings underscore this shift for profitability.

UHS Doubles Down on Outpatient Behavioral Health Strategy (Behavioral Health Business): Legacy provider UHS reports 6% Q3 outpatient revenue growth (2.4% YTD), opening 10 new “step-in” programs by year-end under Thousand Branches brand. Focus: Freestanding/virtual therapy to capture non-hospital demand; modest capex ($1–2M/site) but staffing challenges noted. Inpatient up 9%, total BH revenue +9% to $1.86B.

Branding & Leadership

Health Orgs Refresh Identities for Unity and Advocacy

Rebrands signal strategic alignment in fragmented markets, emphasizing mission-driven cohesion. In a post-merger, post-pandemic era, orgs like BJC and CHA are streamlining brands to amplify influence. Watch for ripple effects in policy lobbying (e.g., tying into 340B debates) and talent attraction.

BJC Health Drops ‘System’ in New Enterprise Brand (BJC.org): St. Louis-based nonprofit (48K employees, 24 hospitals) unveils “BJC Health” with tagline “Because every moment deserves exceptional care.” Unites East/West regions post-merger; rollout starts early 2026.

Children’s Hospital Association (CHA) Launches Bold New Brand (ChildrensHospitals.org): CHA (200+ hospitals) rebrands to elevate kids’ health as a national priority, with mission focused on data-driven advocacy (e.g., Medicaid, mental health). Announced at ALC conference; CEO Matthew Cook: “Unify perspectives, drive progress.”

Innovation & Tech

AI and Data Platforms Accelerate Discovery

Big bets on computer power and insights to bridge digital divides with pharma and providers taking the lead. From Mayo’s democratized insights to Lilly’s supercomputer muscle, these moves signal AI’s shift from hype to core operations. Benefit of accelerated drug dev cycles but also raises equity concerns.

Mayo Clinic Launches Platform_Insights for AI-Driven Quality Improvement (Mayo Clinic News Network): New offering shares Mayo’s data expertise (26PB from global network) via AI tools for providers worldwide. Aims to reduce AI adoption barriers; COO Maneesh Goyal: “Extend reach for better decisions.”

Mount Sinai Opens $100M Hamilton and Amabel James Center for AI and Human Health(Fierce Healthcare): 12-story Manhattan facility (65K sq ft) houses 40+ investigators, 250+ staff for AI in genomics, imaging, and EHRs. Dean Eric Nestler: “Revolutionizing doctors’ capacity to diagnose and treat patients.” Ties to Windreich Dept. for system-wide deployment.

WashU Medicine and BJC Health Launch Center for Health AI (WashU Medicine): St. Louis joint venture focuses on personalized care via AI (e.g., surgical blood loss prediction). Chief AI Officer Philip Payne: “Transform health care... more effective for patients and efficient for providers.” Builds on broader AI institutes for imaging and innovation.

Eli Lilly, Nvidia Build Pharma’s ‘Most Powerful’ Supercomputer (Fierce Biotech): Lilly’s “AI factory” (world’s first Nvidia DGX SuperPOD) for molecule discovery, imaging, and digital twins. Runs on renewables; SVP Thomas Fuchs: “AI as scientific collaborator.” Models shared via TuneLab for biotechs.

“Lilly is shifting from using AI as a tool to embracing it as a scientific collaborator,” said Thomas Fuchs, senior vice president and chief AI officer at Lilly

Employers & Benefits

Employer Benefits Hit Record Highs

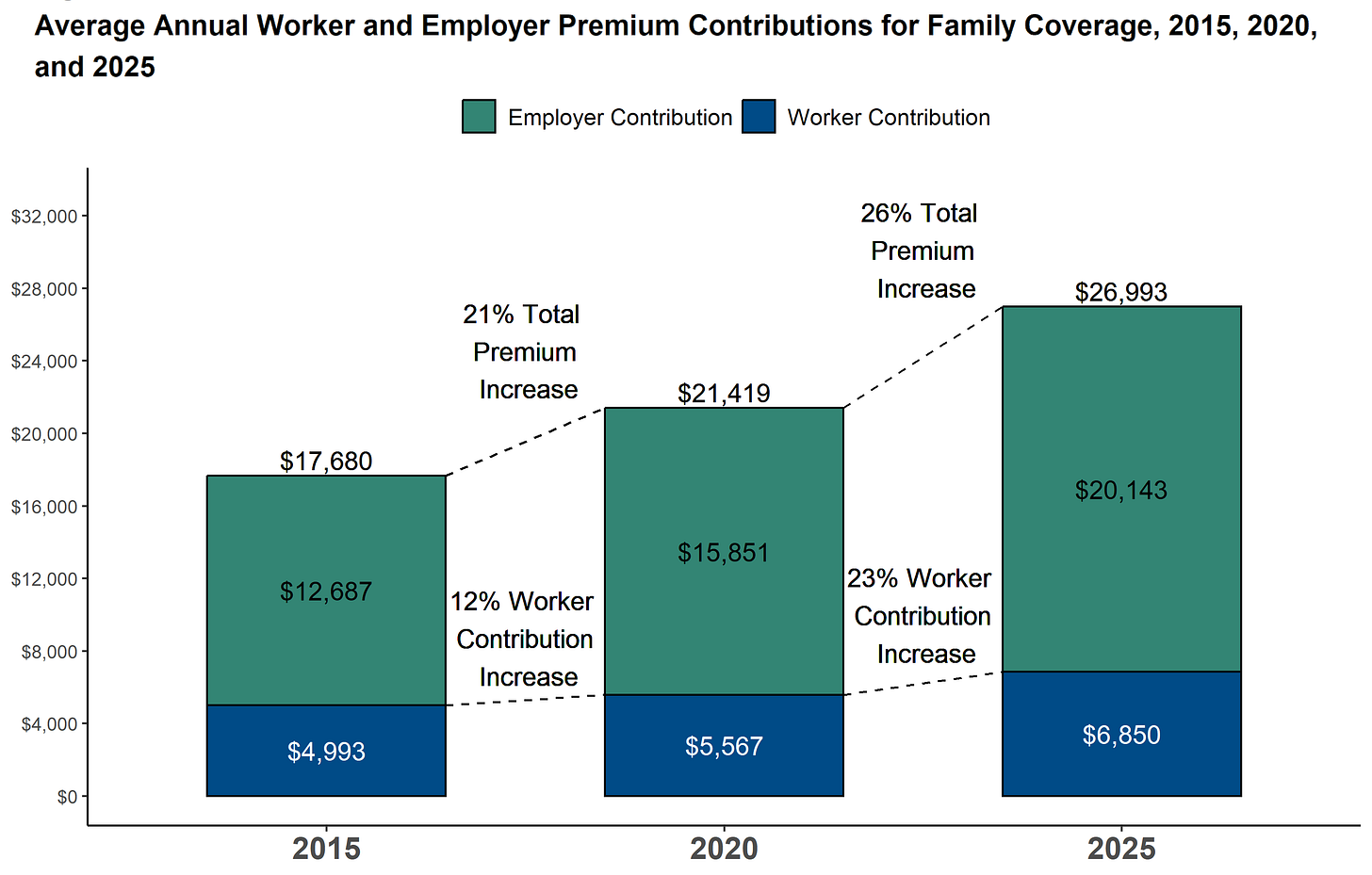

Broad trends in coverage costs and access, tying into broader policy themes. As premiums outpace wages (26% vs. 29% over 5 years), employers grapple with GLP-1 demand and narrow networks, mirroring payer pressures and visa-driven shortages.

KFF’s 2025 Employer Health Benefits Survey (KFF.org): Family premiums average $26,993 (+6% YoY); workers contribute $6,850. Deductibles at $1,886 single. 51% offer GLP-1s for weight loss; networks narrow (41% “narrow” for primary care). Wages/inflation lag premium growth; Medicaid seen as “very important” by 40% of large firms for employee coverage.

Sources: All summaries based on linked articles. For deep dives, visit the URLs.

Feedback? Reply to mark@trendlinehealth.com