The $5.6 Trillion Puzzle: 2025 in Review | Trendline Health – December 18, 2025

Edition 6 | National Health Expenditures • Year-End Retrospective

Trendline Health | Edition 6 – December 18, 2025

The Interwoven Complexity of Healthcare

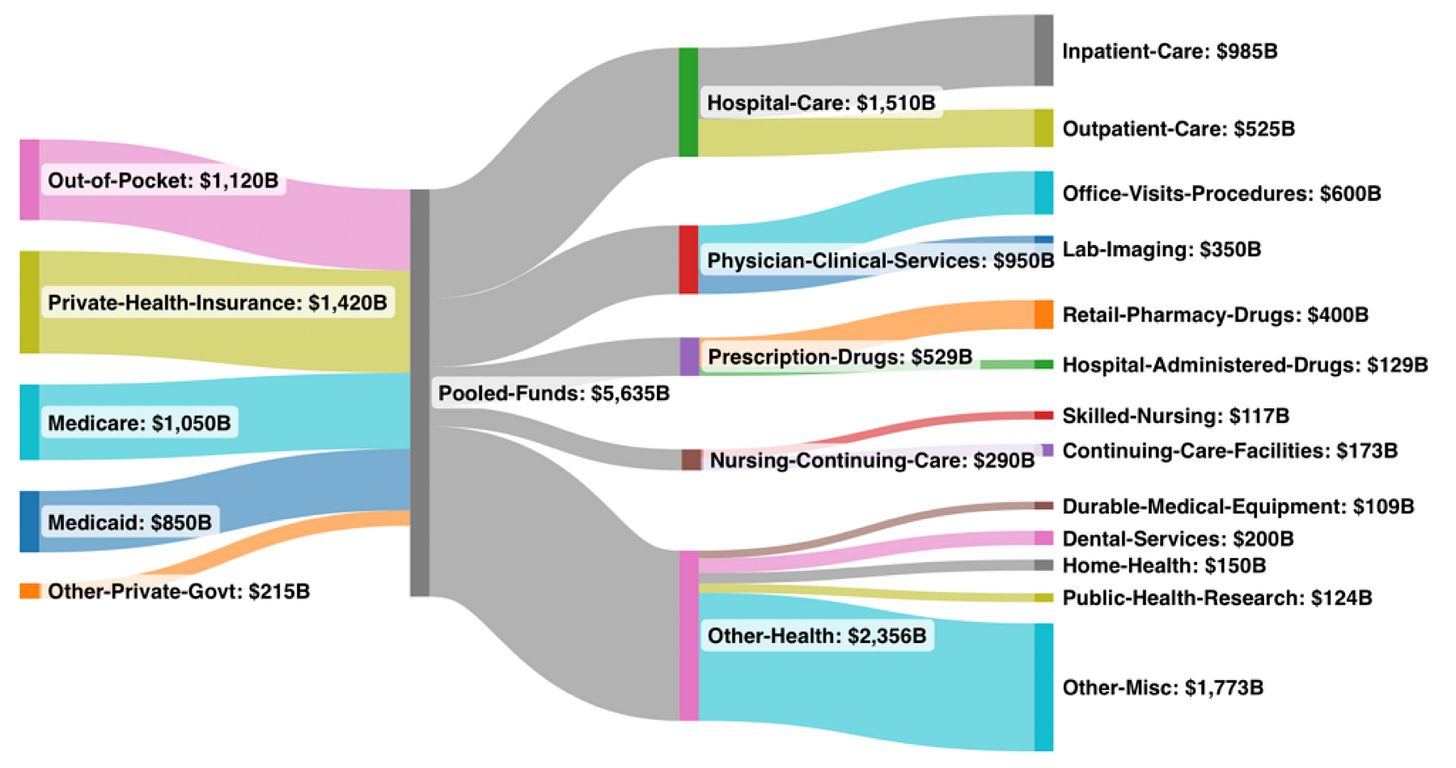

U.S. healthcare spending will cross $5.635 trillion in 2025 — more than the entire economies of Japan and Germany combined. That $5.6 trillion accounts for all the money flowing into the system: Medicare/Medicaid, private health insurance, out-of-pocket, as well as where all those dollars are being spent.

CMS National Health Expenditure Projections (June 2025 release)

It’s a massively complex industry that continues to grow and seemingly no obvious starting point to right-size the economics and bring it back to a patient/customer centric industry. How do you eat an elephant? One bite at a time, so the saying goes. But if there are multiple elephants, it can be paralyzing to think about how and where to begin.

Drugs - The Tip of the Spear

So many points of dysfunction to attack, yet the fiercest policy fights, employer RFPs, and state legislative battles aren’t over the $1.51 trillion hospital sector or the $950 billion physician complex. They’re over the $400 billion retail prescription-drug slice, just 7.1 % of total spend.

Why?

Because drugs are still the most visible, most volatile, and most actionable lever in a system that has quietly consolidated into three vertically integrated giants now controlling ~80% of every prescription filled in America.

The only category that has meaningfully gained share over a quarter-century is “Other”, and inside that bucket sits the fastest-growing cost of all: administrative overhead, now approaching 10% of total NHE and projected to top $560 billion in 2025.

Why isn’t anyone swinging at that bigger target? Because administrative bloat is diffuse, politically protected (insurers, PBMs, and hospital systems all fund the same lobbying groups), and lacks the consumer-facing outrage of a $1,000 copay. Drugs, by contrast, deliver three irresistible qualities:

Visibility – Patients see the sticker shock.

Volatility – One new GLP-1 or gene therapy can move total drug spend 8–12 % in a single year.

Actionability – An executive order, a transparency rule, or a Mark Cuban-style direct model can shave billions in months, not decades.

The vertical integration of the drug channel resulted in three conglomerates owning the payer, the PBM, the specialty pharmacy, the retail counter, and increasingly the clinic itself. These behemoths created a closed-loop profit engine that is finally visible enough to attack.

Coming Next

In the coming editions, we will take a closer look at these large spend categories (see Sankey diagram, above) to help illustrate how we got here and some likely next steps:

Prescription Drugs (the wedge)

Hospitals (the immovable object)

Physician Consolidation

The Administrative Overhead Explosion

Bending the Trendline: The Five Storylines That Defined 2025

1. PBM Reform Accelerates Under FTC Scrutiny – The Big Three faced unprecedented heat, with the FTC’s September administrative complaint (and November motion opposition) marking the first major challenge to vertical integration as a “theory of harm.” Year-long rebate probes revealed $100B+ in retained savings, forcing states like California to ban spread pricing by mid-year. Impact: Projected $20-50B in 2026 drug cost relief (7.1% NHE slice), but litigation drags into 2027 setting the stage for bipartisan bills in the new Congress.

2. GLP-1 Drugs Reshape Chronic Care Economics – Ozempic/Wegovy demand surged 150% YoY, driving $50B+ in new spend (11.4% drug growth spike), but Q4 cash-pay discounts (Novo 40% cut November) and biosimilar entries trimmed list prices 20-30%. Impact: Shifted $15B from obesity/cardio categories to “Other” (45.5% NHE), pressuring employers on premiums while boosting behavioral integration but access gaps widened for low-income plans.

3. Medicare Advantage Benchmarks and Risk Cuts Squeeze Insurers – CMS’s April final rule (+5.06% headline, but V28 model offsets to ~1% net) triggered mid-year benefit trims in 40% of plans, amid $25B total infusion. Impact: Stabilized 18% NHE share but fueled narrow networks, adding $10B in OOP costs, exacerbating the “Other” admin bloat as payers clawed back margins.

4. AI Adoption Explodes in Diagnostics and Admin – Ambient voice tools went “table stakes” (used in 70% of physician notes by Q3), while predictive analytics cut readmissions 15% in pilot systems. Impact: Saved $30B in admin/physician spend (17% NHE), but cybersecurity breaches (e.g., Change Healthcare sequel in June) cost $11M average, highlighting the double-edged sword in the 10% overhead surge.

5. Private Equity Hospital Roll-Ups Hit FTC Wall – Deal volume plunged 25% YTD (only 11 platforms by November), after three blocks in Q2-Q3 and Apollo/Blackstone fund shelves. Impact: Slowed consolidation in the 26.8% hospital slice, potentially curbing $15B in price inflation but stalling efficiency gains, a rare win for antitrust in a year of unchecked verticality.

That’s our look back at the year that bent, but didn’t break, the $5.6 trillion curve.

In January we launch a four-part series starting with the wedge everyone can actually move: Prescription Drugs.

See you in 2026!

Got Feedback? Comment or email mark@trendlinehealth.com to let us know if you like this new format as a template for our main newsletter: a thought-piece followed by 5 Storylines that are “Bending the Trendline”. Our State sections (like IN Pulse and coming soon, OH Pulse) will continue with the weekly news roundup format.